There is a lot to consider in the world of marketing. Marketing managers and top executives must be constantly mindful of the product they are selling. This must happen in such a way as to convince a prospective audience that their product is the best option amongst the plethora of available alternatives. Marketers are concerned with the advertising, content, distribution, placement, media, brand, and image, along with a slew of other tasks, concerns, and headaches.

Somewhere along this winding road of brand development, a pricing strategy must be developed. There are many pricing models that exist in the world. Every-day-low-pricing, cost-plus pricing, and penetration pricing to name a few. But many people fail to recognize, or fully appreciate, the power of psychological pricing.

Psychological pricing is just as it sounds: a pricing theory based on the idea that certain prices and price displays elicit a desired psychological response from a consumer. Let’s delve into a handful of psychological pricing tactics, look at the underlying theory, and think about how you may be able to implement them to drive revenue in your organization.

1) “Useless” Price point

The Theory

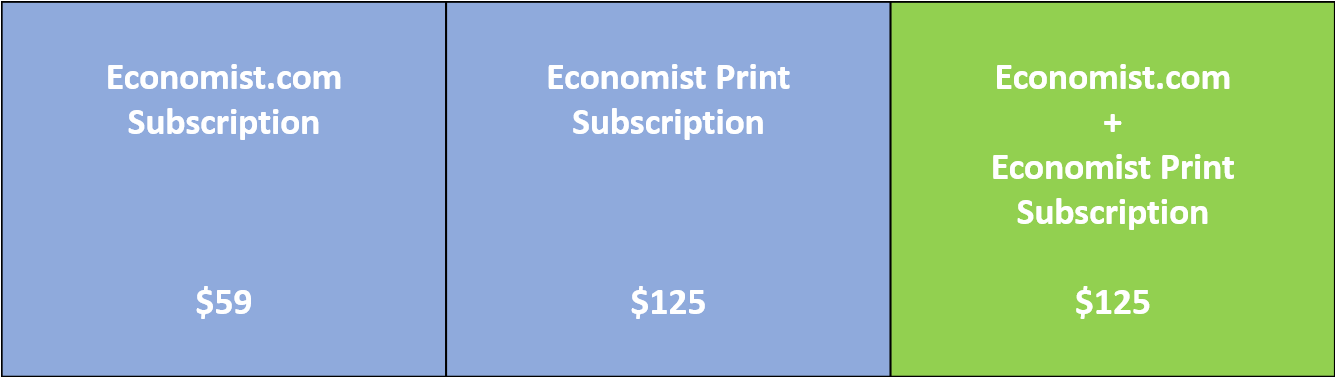

One of the most fascinating ideas in pricing that I have come across is the implementation of a “useless” price point. While these price points themselves may be useless, their inclusion does indeed have a valuable purpose. That purpose is to drive consumers to subconsciously consider, then ultimately purchase, a more expensive pricing option. To explain, we will look at the example that Dan Ariely introduced in his book Predictably Irrational, of the Economist and their subscription model.

At one time, the Economist offered users these pricing options for their subscriptions. Yes, offering the print only and the print+digital for exactly the same price. Clearly, no rational individual would ever purchase the print-only edition. Why would they when they could get all the benefits of this PLUS the benefits of the digital edition for the exact same price? But the point is not to sell any of this option. Merely including this “useless” pricing option alters a viewers perception of the pricing situation. This alteration drives purchasers away from the low-priced option and towards the higher one.

The Effect

In his research, Ariely noted that before adding this useless option, 68% of users selected the $59 subscription option while only 32% opted for more expensive $125 option. Not horrible, but watch what happens when they added this extra pricing option. Simply presenting the same pricing options alongside the uselessly priced print-only option changed these numbers to 16% for the digital and 84% for the print+digital, of course with no one selecting the print-only option. This is an astounding 52 percentage point increase in $125 plan purchases. To put this in dollar terms: for every 100 subscriptions sold, merely including this option generated an additional $3432 in revenue.

Essentially this additional price point takes customers who are “bargain hunters” and reframes their perception to turn them into “value seekers”. Instead of simply looking for the cheapest option, they seek the one which provides the greatest value for their dollar.

Putting it to use

Perhaps adding a useless or less than ideal pricing option can help your business drive revenues. Or you can consider adapting this approach slightly and pricing one class of good only slightly below a far superior class. Maybe you could even include an ‘add-on’ package that ultimately renders one of your price points inferior. Doing so would have the same effect and drive consumers to more heavily consider the dominating price option.

2) Order: price first or product first

The Theory

The order in which companies expose their customers to the price and the product also has a profound impact. When customers see the product first in this sequence, purchase decisions tend to be based more on the product qualities. Alternatively, when the price is displayed first, these purchase decisions are based more on the economic value of the item.

Traditionally, it is better for “luxury” items, such as designer handbags or corporate SaaS bundles, to be presented before their price. The opposite is true for utilitarian or discount goods.

I was recently in Lucerne and couldn’t help but looking at the Patek Phillippe boutique to try and find the most absurdly priced wristwatch. Much to my chagrin, I found that there was not a single visible price in the store window. As an ultra-luxury retailer, Patek Phillipe knows the benefits of selling their clients on the features and quality of their watches before revealing the staggering price tag.

Contrast this to any shopping experience at a dollar store or discount mart. Even before walking through the doors many of these establishments have large signs advertising items for only $1 or $2. By presenting the product and price in this order, these retailers are priming your perception. They are gearing you up to ponder the good in terms of its low price before exposing you to the often comparatively lacking set of features.

Putting it to use

To effectively employ this tactic you need to examine your own business. By doing this, you can determine which type of good or service you are providing for your clients. Perhaps you have developed an ultra-powerful sales tool that you want to charge a hefty fee for. In this case, it might be best not to display the price on your website, but to instead only reveal it after a detailed product demo where you explain the full suite of benefits.

3) Price anchoring

The Theory

Price anchoring is the practice of providing a frame of reference with which consumers can place a product. An excellent example of this, also put forth by Dan Ariely in Predictably Irrational, is the company Williams-Sonoma and their breadmakers. Williams-Sonoma sold a simple, in-home breadmaker to consumers priced at $275.

When the company first launched the breadmaker, they experienced limited sales. Consumers were not familiar with this type of product. There was no frame of reference in their mind to compare a Williams-Sonoma bread-maker to and thus they had nothing to base purchase decisions on. Noticing that sales were lacking the company took an unconventional approach. They decided to produce and sell another, deluxe version of the breadmaker priced at $400.

This gave customers something with which to compare the simple model. With this reference point established, more consumers were more heavily drawn to the simple model and sales increased drastically.

Putting it to use

Marketers can use price anchoring in many different industries. The applications for manufacturers of personal goods are clearly displayed in the example of Williams-Sonoma above. However, there are many other applications beyond this. Take, for instance, Software as a service providers. Adding a high priced package to a SaaS pricing page can anchor customer perceptions in a different place. Most consumers, as a general rule, tend towards the middle option in a list of prices. By adding a higher price, what once would have been considered too premium of a choice, now seems much more feasible when compared to this newly added higher price point.

4) Price Installments

This is a tactic already adopted by many technology-based service providers. The human brain is wired to spend til it hurts. That makes the use of price installments or monthly subscription pricing so effective. This is because of the notion that it far easier, psychologically, for a customer to look at a pricing plan and justify a meagre $2 per month payment than it is for them to justify a $100 one-time payment. This comes despite the fact that a continuous subscription can, over a long time period, add up to a much larger sum than a one-time up-front purchase would have been.

5) Removing ‘Syllables’

This has to do with the way that the actual number of the price is displayed. Take for instance: $1,499.00 and $1499. While both of these represent the exact same price, $1,499.00 appears, psychologically, to be much larger than $1499. This is partially due to the way that we would ‘say’ these numbers to ourselves in our head: “One thousand four hundred and ninety-nine” vs. “fourteen ninety-nine”. Exact same number, two different ways of writing it, two very different ways of perceiving how large this sum is.